However, they can occur in the middle of a strong upward movement, in which case the bullish movement at the end of the wedge is a continuation of the overall bullish trend.īoth rising and falling wedges can occur over both intraday and months-long timeframes, although intraday wedges can be difficult to identify with much certainty.

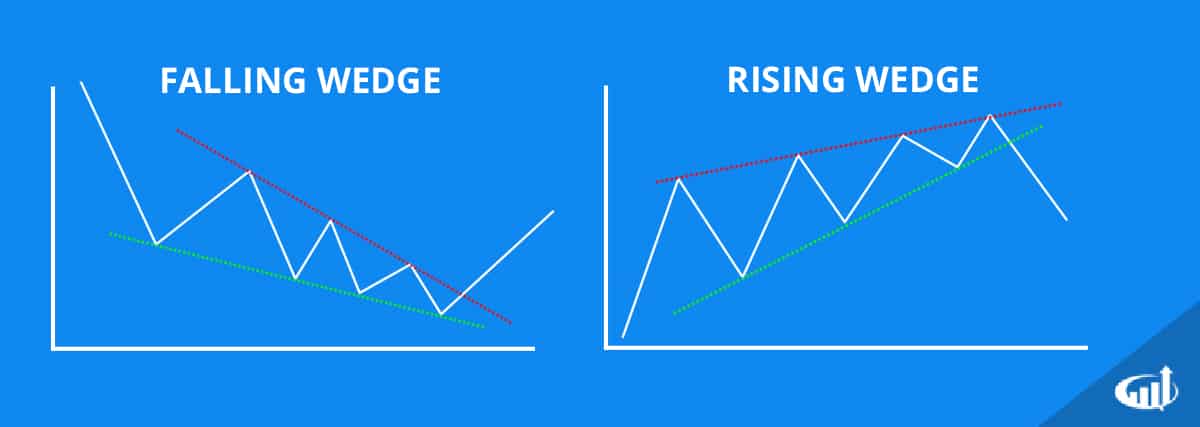

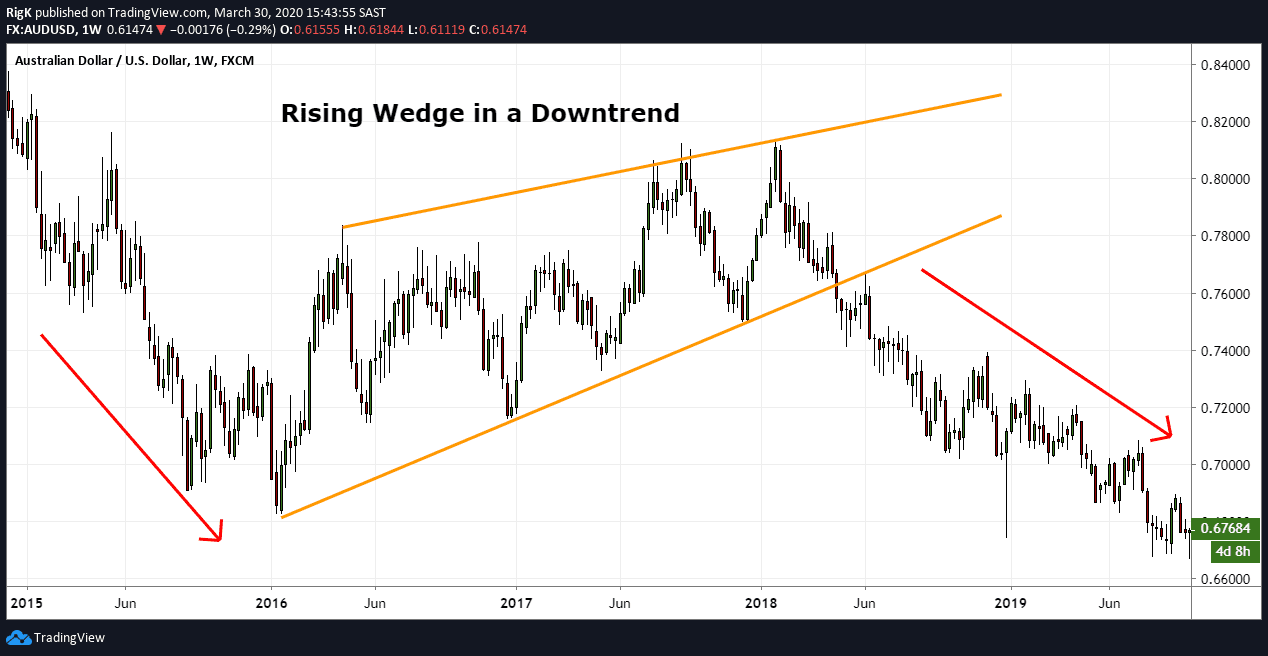

They develop when a narrowing trading range has a downward slope, such that subsequent lows and subsequent highs within the wedge are falling as trading progresses.įalling wedges are typically reversal signals that occur at the end of a strong downtrend. In this case, the bearish movement at the end of the rising wedge is a continuation of the main downward trend.įalling wedges are the inverse of rising wedges and are always considered bullish signals. However, rising wedges can occasionally form in the middle of a strong bearish trend, in which case they are running counter to the main price movement. This means that in contrast to ascending triangles, both subsequent lows and subsequent highs within the wedge pattern will be rising as the trading range narrows towards the apex of the wedge.Īs bearish signals, rising wedges typically form at the end of a strong bullish trend and indicate a coming reversal. Rising wedges are bearish signals that develop when a trading range narrows over time but features a definitive slope upward. Wedge patterns can be difficult to recognize and trade effectively since they often look much like background trading activity on charts. However, unlike symmetrical triangles, wedge patterns are reversal signals and have a strong bias towards being either bullish – for falling wedges – or bearish – for rising wedges. This chart pattern changes the trend from bullish to bearish.Wedge patterns are chart patterns similar to symmetrical triangle patterns in that they feature trading that initially takes place over a wide price range and then narrows in range as trading continues. The prior trend to the double top pattern should be bullish, and it must form at the end of the bullish trend.

The neckline is drawn using the last swing low after two tops. After the neckline breakout, a bearish trend reversal happens. The double top is a bearish reversal chart pattern that shows the formation of two price tops at the resistance level. These patterns have a high winning probability. There are several repetitive chart patterns in the technical analysis, but here I will explain only the top 24 chart patterns. These two patterns are classified into many chart patterns based on the shape and structure of the market. Types of chart patternsĬhart patterns are categorized into two primary types based on the trend direction. Traders use these repetitive patterns to forecast the market.Ĭhart patterns are made up of price waves or swings on the candlestick chart, such as head and shoulder, double top, and triple top patterns. These patterns repeat with time due to natural phenomena. What are chart patterns?Ĭhart patterns are the natural price patterns that resemble the shape of natural objects like triangle patterns, wedge patterns, etc.

Stock chart rising wedge pdf#

At the end of the article, you will get a chart patterns PDF download link for backtesting purposes.

You can also learn the chart patterns with trading strategy by pressing the learn more button. In this article, you will get a short description of each chart pattern. Retail traders widely use chart patterns to forecast the price using technical analysis. Twenty-four chart patterns have been discussed in this post.

0 kommentar(er)

0 kommentar(er)